Retirement has changed; our financial preparation should change, too.

Current research highlights that 55% of Americans are concerned that they cannot achieve financial security in retirement. There are a plethora of reasons why (longevity, inflation, cost of living, and stagnant wages, to list a few), but let’s focus on moving forward.

Saving more, reducing debt, and adjusting your lifestyle have long been the mantra in planning for retirement. While these are excellent and effective strategies, they are often not enough. What worked for generations before us will no longer be enough. With “save more, spend less” as a single solution, you would need to save around 40% of your income over the course of 30 years of working. This MIT academic research calculation also assumes that you will live off half your final salary in retirement years.

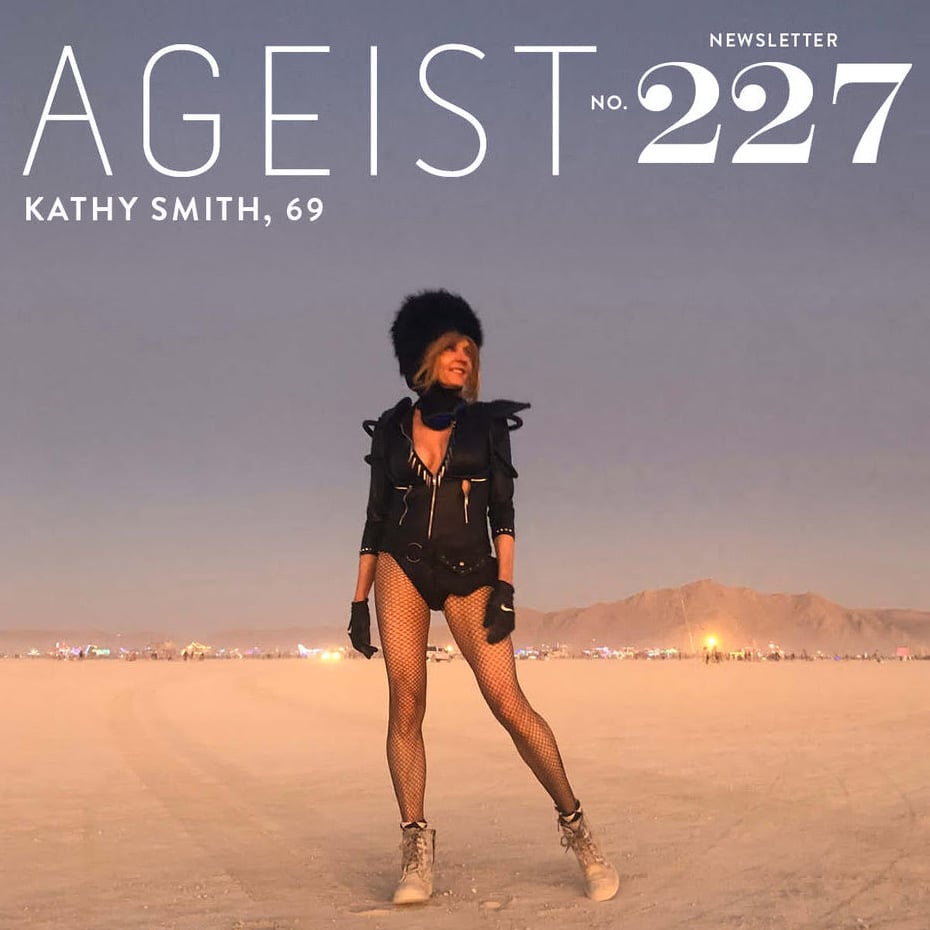

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

Adding an income stream to retirement planning

We’re all familiar with the economic adage around your money needs to make money. The idea behind this advice is to allocate your resources wisely — invest in assets that have the potential to grow and generate income, rather than letting that money sit idle or generate low interest rates that do not keep up with inflation.

Retirement planning is as personal as the lifestyle you are looking to support. Whether you are a DIY investor or prefer to rely on the expertise of a financial advisor, there are several paths to building an income stream for retirement years. (We strongly recommend partnering with an expert, unless very detailed research happens to be your passion.)

- Invest in Dividend-Paying Stocks: Dividend-paying stocks can provide a regular income stream from the dividends distributed by the companies. Choosing well-established, financially stable companies that have a history of consistent dividend payments can provide a reliable source of income during retirement. This is definitely an area where you’d benefit from partnering with a financial professional.

- Rental Real Estate: Owning rental property can generate a steady stream of passive income. Real estate investments can offer both rental income and potential property value appreciation. In addition to considering your local market conditions and the time you have to manage the needs of short- or long-term renters, you should also look at the capitalization rate when evaluating the purchase of rental property.

- Annuities: Purchasing an annuity can provide a guaranteed income stream for a set period of time or for as long as you live. Annuities can be a good option for those seeking a stable, predictable income in retirement. As with the purchase of any financial product, it’s important to thoroughly understand the fees and features of an annuity contract to determine if this option is right for you. Working with an advisor or firm with expertise in annuities will help here as there are a variety of options to choose from depending on your unique needs.

- Part-Time Work or Consulting: Leveraging your professional skills and experience in a part-time or consulting capacity can be a fulfilling way to generate income. Known as an encore career, this approach not only provides financial benefits but also keeps individuals engaged and active in their field of expertise. When my mom retired from her nursing career, she worked as a school nurse 2 days a week and this community was invaluable to her.

- Create a Business: Starting a business, particularly in an area of passion or expertise, can be a rewarding way to generate income. In the United States, individuals aged 55-64 have the highest rate of entrepreneurial startup activity among all generations. The years of career and life experience of our age groups have led to impressive success. Entrepreneurs aged 50 and up are seeing success at a much higher rate than those starting businesses in their 30s or younger.

Investing your time and money into building a diversified portfolio that includes an income stream can contribute to financial stability and allow for a more flexible and secure lifestyle in retirement.

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

Be your own advocate as you know best what you need

The variety of strategies available to prepare for our retirement years is more diversified than ever, allowing you to be intentional with your planning. Yet, as products and solutions continue to evolve, it is important to work with someone that listens to your specific wants and needs.

We’ve seen this type of need for personal advocacy in the healthcare system. Patients and caregivers are often put in a position of persistent advocacy to be heard and to receive the treatment they need. If your financial professional seems “stuck in their ways” or is reluctant to explore new avenues with you, then find someone else. You’ve worked too hard to settle for following someone else’s roadmap.

P.S. The world is still looking to replace the word retirement. If you have any ideas for us, or thoughts you’d like to share, please use the comment box below. We always enjoy hearing from our readers!

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

I just checked my retirement account today! I do hope to get some real estate down the road but need to get the kids off the payroll first.

Checking your account regularly (but not too often) is a great way to ensure you are on track and to hold yourself accountable. Yes, getting kids “off the payroll” can free up a bit of money to boost those retirement planning efforts.