Downsizing has traditionally been a strategic option for retirees and pre-retirees, but real estate market experts are currently divided on what this trend will look like over the next few years. Seen as a blend of opportunity and challenge, many homeowners downsize to simplify their lifestyles, reduce upkeep, or adjust to their changing financial landscape. This trend (which I recently saw ridiculously referred to as a “silver tsunami of baby boomer downsizing”) is particularly challenging due to our current low-rate mortgage environment, which complicates the decisions around downsizing.

We thought we would delve into the complexities of downsizing amid these historically low mortgage rates, evaluate some of the lifestyle factors at play, and explore potential options for those of you considering this significant life change. I’ve recently been through this entire emotional process from beginning to end with my mom. For those of you who have never been a part of or witnessed this decision making process, buckle up — it can be wild, emotional, stressful, and very successful.

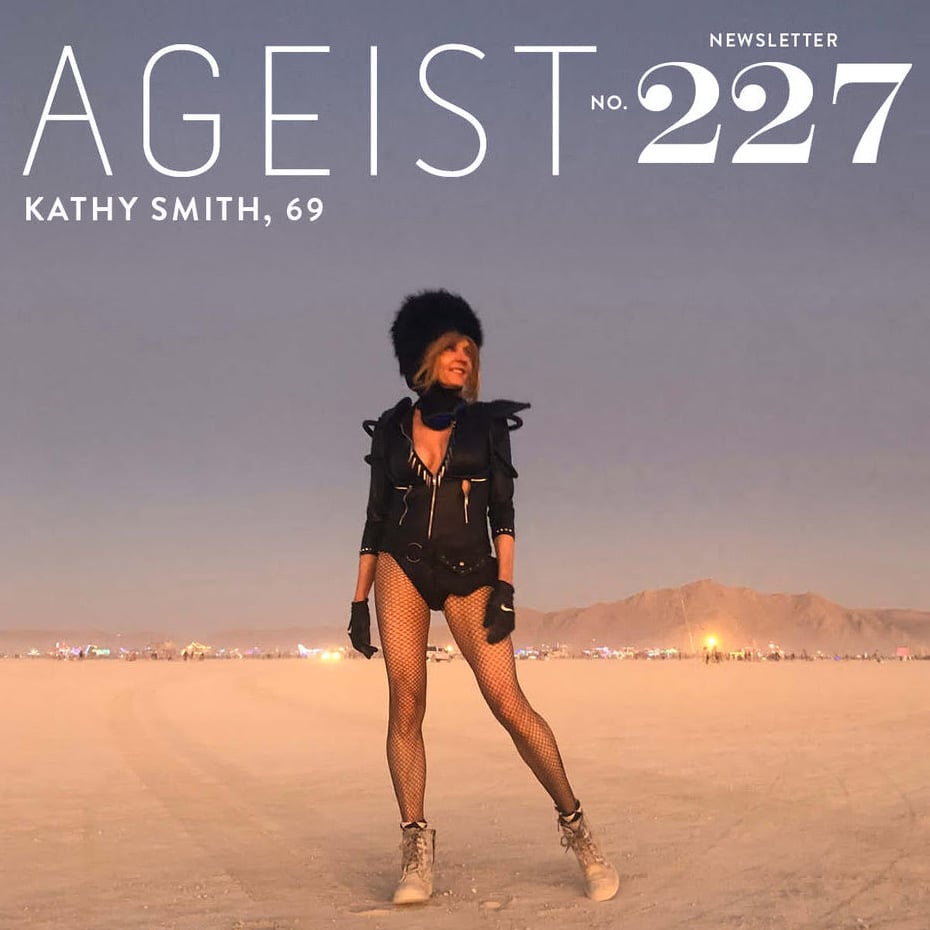

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

The Low Rate Mortgage

Currently a defining feature of our financial landscape, these mortgages offer homeowners the ability to borrow at historically low rates. Characterized by significantly lower interest costs, the monthly financial burden on homeowners is drastically reduced. Historically, this type of rate is a result of monetary policy decisions by central banks looking to stimulate economic growth by making borrowing more accessible and more affordable. This resulted in an ability for many to buy a larger home or refinance for lower monthly mortgage payments.

The Lock-In Effect of These Low Rates

An unintended consequence of these low rates has been their “lock-in” effect. Homeowners are not willing to sell their current homes because they are unable to secure a similarly low mortgage rate on a new property. This creates both a financial and psychological barrier to downsizing as the increase in interest payments will offset the desired savings we usually see when moving to a smaller home. Initially, my mom did not want to take on downsizing due to this “lock-in effect” — if she was not going to be able to save a good bit of money, she was not going to move.

Homeowners who are locked in at ultra-low rates may face higher costs if they choose to downsize and secure a new mortgage at current rates — even if current rates are relatively low by historical standards. The lock-in effect often makes the hassles of downsizing seem not worth it.

Market Trends, Home Values and Capital Gains

The current real estate market further complicates the downsizing equation. In many areas, home prices have risen significantly, leading to a large increase in equity for many homeowners. This equity is a powerful asset for those looking to downsize, as it provides substantial financial flexibility. However, it can lead to capital gains and tax implications — so, it is wise to speak to a financial professional about this when evaluating your options.

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

The Upcoming Changes to the Real Estate Commission Structure

The key potential change here centers around who will foot the bill for real estate agents representing the homebuyer. Under this change, the seller is no longer required to cover the commissions or fees for the buyer’s agent. This would allow homeowners looking to sell the ability to negotiate commissions or fees, as well as the ability to forgo paying the buyer’s agent fees. The goal for the seller would be to pay less in commissions and be able to make more money off the sale of the home.

There are already concerns being raised. Will the buyer need to make a lower offer to be able to pay their broker? Will the seller need to negotiate with the buyer’s agent in order to make the transaction work financially for the buyer? One of the goals was transparency in commission structure, and that will probably happen. The bottom line is: someone selling their home can now negotiate the commissions and fees related to the sale of their home. If this will lead to sizable savings for the seller remains to be seen.

Options in Downsizing

When weighing the options around downsizing, the good news is that there are a few paths to choose from:

- Stay Put: If it is financially manageable and suits your lifestyle needs, staying in your current home is a popular option. This decision often stems from an emotional attachment to the home and the community as well as the cost savings of not moving. My mom chose this path until her home no longer met her lifestyle needs.

- Downsize: A smaller home can be a smart financial and lifestyle choice, especially for those looking to reduce maintenance responsibilities or have a single-story floor plan. The key is to consider the financial implications due to a change in mortgage rates, the upcoming commission changes for the buyer, and the impact of possible capital gains.

- Rent: If you are not ready to make a long-term housing commitment or if you want to see if a new location suits your lifestyle, renting does offer flexibility. It removes the burden of home maintenance and gives you time to adapt to life changes. But, keep in mind that, in some areas, rent prices are historically high.

- Reverse mortgage: Homeowners 62 and older can convert a portion of their home equity into cash while retaining homeownership. The available funds can be a lump sum, fixed monthly payment, or line of credit — without the obligation of monthly mortgage payments. The balance of the loan is due when the home is sold or vacated. It is important to pay attention to the closing cost and interest rates when evaluating a reverse mortgage, as they can impact your equity over time.

- Mortgage assumption: This option allows a buyer to take over the existing terms, payments, and interest rates of the original borrower (subject to lender approval). This could be attractive to heirs in this low rate mortgage environment — and, assuming an existing mortgage is often quicker, involves fewer closing costs, and has a lot less paperwork than obtaining a new mortgage.

The Choice Is Personal

The decision around downsizing — especially against the backdrop of low-rate mortgages and the upcoming changes in real estate commissions — requires a multifaceted analysis of financial, lifestyle, and market factors. While the lock-in effect of low-rate mortgages poses a unique challenge, the potential benefits of downsizing — whether for financial simplicity, lifestyle change, or preparation for the future — remain significant. Ultimately, the choice is personal.

P.S. If any of our readers are currently considering downsizing (or if you’ve been a part of the process in some way), let us know in the comment box below. We’d love to hear from you.

Get super helpful articles like this for free with the award-winning best-in-class AGEIST weekly magazine here.

Another consideration I don’t often see is your current health situation. It’s much smarter and better to take on these large decisions while in good health. I’ve been through this with 3 family members who waited too long -their health failed – and they were unable to manage down sizing and all that comes with it. The result was assisted care.

Thank you for bringing that up! I agree – having gone through this with my mom in the past year and my grandparents (on both sides) before that. I was very fortunate that my mom led the charge on downsizing – she was able to take an active part in looking for her new place, in the move, and with the estate sale. She read the article and said “I am so glad to be on the other side of this now”. It is such an important life change and thinking about it ahead of time is valuable.

Interesting timing of this article and the issues it raises. We are considering downsizing for a few reasons including reducing housing costs, less maintenance and a 1-story home. We are seriously considering a condo. Concerns to making the transition include repairs needed to our current home (husband not in good health) and high cost of homes. The last can be offset by the value of our current home and equity. You may be able to sell and pay for a condo outright.

It is certainly a decision with quite a few challenges – and options. A good realtor can help discuss your concerns around home repairs. My mom was torn about home repair needs as well. Her realtor suggested waiting to see what the inspection report would show and to see what the buyer may want. (Example – do you replace worn carpet, or see if a buyer plans to put in hardwood.) Good luck in your decision making and transition – let us know how it goes!

Interesting timing of this article and the issues it raises. We are considering downsizing for a few reasons including reducing housing costs, less maintenance and a 1-story home. We are seriously considering a condo. Concerns to making the transition include repairs needed to our current home (husband not in good health) and high cost of homes. The last can be offset by the value of our current home and equity. We may be able to sell and pay for a condo outright.

We have lived in our home 30 years and are beginning to think about this, as we have a large yard and no first floor master. But we have a 15 year 3% mortgage. I don’t understand your statement that mortgage rates are at a historical low?

Yes, one of the discussion points here is that many homeowners are currently benefiting from a low-interest rate mortgage (like the one you mentioned). As mortgage rates rise, the challenge is not necessarily finding a smaller, suitable home – but that the new mortgage associated with that smaller home might be equal to or more than the current monthly mortgage payments. Thus, the “lock-in effect”.

I am in the position, at nearly 74 , of wishing to leave my marriage… a grey divorce? The older condo I want to purchase outright ,from proceeds of our lovely ranch style home, is still filled with furniture left by the resident who has gone into care. The daughter needs a reasonably quick sale, and I want to be that buyer. So far, it seems people are somewhat put off by the belongings in the light filled and spacious condo in an excellent location. Unfortunately, my husband is stonewalling , rather successfully, so I am in limbo, while he dithers about where he will purchase a place… in this area …or deciding to ship/haul all of his belongings back to another province, where he came from. No mortgages will be involved. However, splitting the proceeds from a possible $1,200,000 CAD sale may seem like a lot, but my aim is to find something affordable ,with the right qualities, and have at least $100,000 for the bank to make me feel secure, and allow for updating over time. I may miss this opportunity, especially since more places will come on the market during spring break. A difficult time indeed.

Thank you for sharing your story and experience with us. Downsizing or moving is often a result of very personal reasons or needs. I love that you can “see” potential in a much loved home – which leads me to believe that even if you miss this specific opportunity, another will arise. We wish you all the best as you move through this challenging time of transition.

After launching my three college educated offspring into their lives; I was left dusting rooms I hardly went into.

After my son refused his kindergarten artwork or baby shoes… I got rid of the 35 years of accumulated stuff.

My husband and I downsized to an 1400 sf one story newer house with a postage stamp size yard in a great neighborhood. We travel… lock the door and leave effortlessly. One of the best decision I ever made.

Thank you for sharing your story! My siblings and I went through a lot of memorabilia that my mom had saved over 30 years or so – we each picked a few items that we wanted to hang on to. Agree that much of it was “accumulated stuff”. So glad to hear that you and your husband found the perfect home – a “home base” that allows you to travel! Send us a picture of your next adventure, we’d love to hear about your travels.