With the massive appreciation of real estate in the last 15 years, and the desire to downsize and perhaps move to a more urban environment, some people are finding themselves in the admirable problem of sitting on a pile of cash. In addition to the usual recommendations of index funds mix with bonds, another product one may want to consider when speaking with one’s financial advisor is the annuity. There are various flavors of the product—variable, fixed and others—but the general idea is to provide a predictable income stream throughout your life.

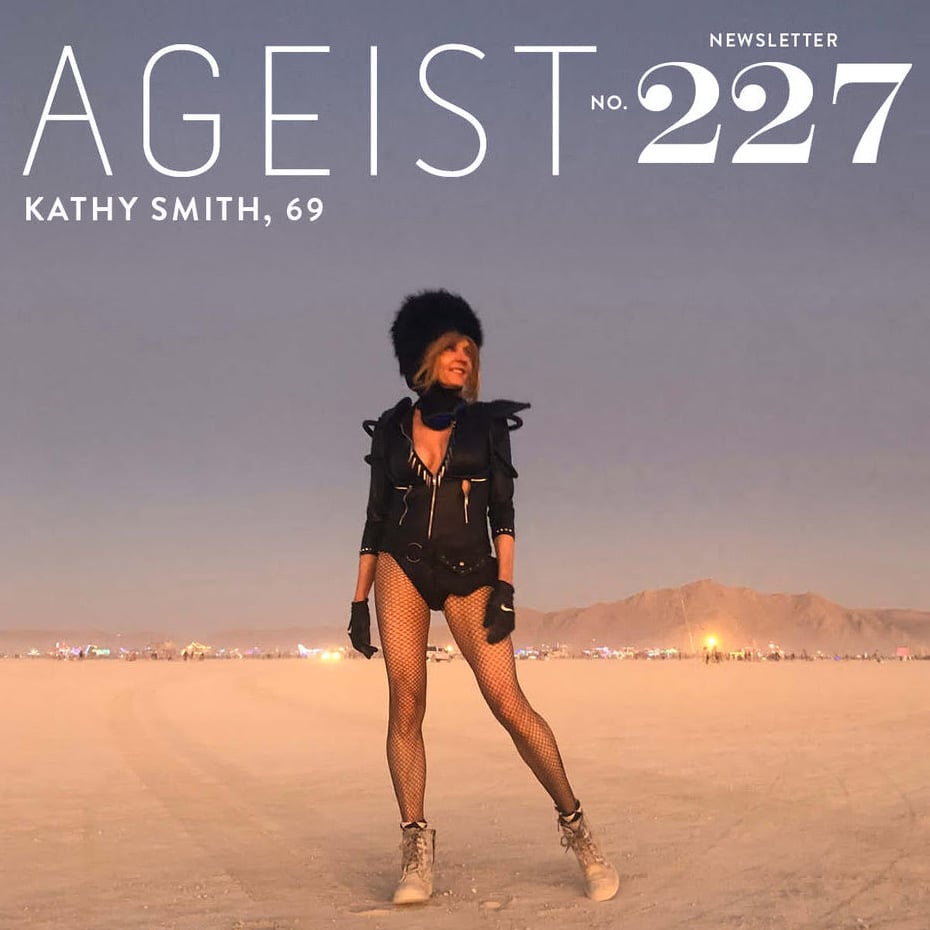

“One of the best places to save for one’s future is in an employer’s retirement plan. But for the person who does not have an employer plan and/or has maxed out all available retirement plan options, including IRAs and Roths, one option that is available for additional tax deferred growth is in a variable annuity. Money goes into the variable annuity and can be invested in a broad range of investment options and taxes get deferred until the funds are withdrawn. Annuities also can have riders to the annuity contract that the investor is interested in, such as downside loss protection.“ That bit of wisdom is from our MBA/CFP expert Scott Brewster. One should pay close attention to fee structures and to capacity of the financial entity to be around for the long haul. A nice site that the industry has made to read more about them is here. We don’t have an opinion on the product, but we very much like the vibe of the site and the badass smoke jumping woman- they get it in terms of who our gang is. Always discuss any major financial matter with a qualified trusted advisor.